|

||||

|

In this Update:

Senate Local Government Committee Reports Out Four Bills, Including Energy Choice, Firearm Regulation Preemption MeasuresThis week, the Senate Local Government Committee, which I chair, reported to the full Senate four bills, three of which were amended by the committee. Reported from committee by a party-line 7-4 vote, Senate Bill 275, sponsored by Senator Gene Yaw (R-23), seeks to ensure that all Pennsylvania businesses and homeowners have the opportunity to access a variety of energy options, whether it be natural gas, solar, wind, geothermal or other. The bill places decisions regarding restrictions on the use of any energy source in housing and commercial energy applications solely within the purview of the state. According to Senator Yaw, with over 2500 municipal entities in Pennsylvania, allowing energy policy decisions to be made at the lowest municipal level would create a policy founded on an unworkable patchwork of restrictions and further deny residents access to differing energy resources. “Having all these different rules doesn’t make any sense,” said Senator Yaw. “This puts control at the state level.” The committee adopted an amendment I offered on behalf of Senator Yaw to clarify the bill does not affect the authority of a municipality to take steps designed to reduce greenhouse gas emissions or purchase renewable energy for municipal facilities and operations. Also approved by the committee by way of a party-line vote, Senate Bill 448 looks to ensure better enforcement of Pennsylvania’s current state preemption over local firearms and ammunition regulations. “As of 2015, there were approximately 100 municipalities that chose to go in direct contravention of existing law and enact their own ordinances attempting to regulate guns,” said bill sponsor Senator Wayne Langerholc, Jr. (R-35). “It’s very clear within the laws of the commonwealth that this body – the General Assembly – is tasked with those types of duties.” Senator Langerholc said his legislation would prevent local jurisdictions from imposing ordinances more restrictive than laws passed by the General Assembly, as well as enhance and restore the original intent of the state’s existing Uniform Firearms Act. “This would allow a person adversely affected to file suit against a municipality which enacts an overly restrictive local firearms ordinance,” said Senator Langerholc. Also reported from committee, by way of unanimous committee votes, were Senate Bill 755 and House Bill 430. Senate Bill 755, sponsored by Minority Chair Senator Tim Kearney (D-26), amends Act 247 of 1968, the Municipalities Planning Code, to specifically provide authorization for digital submissions and electronic transmittals of a proposed comprehensive plan or amendment, a proposed land use ordinance or amendment, or an adopted comprehensive plan, land use ordinance or amendment for review, comments or recommendations. The bill would codify what is generally already current practice and eliminate the confusion on whether digital transmittals are permissible. However, the bill does not require documents to be submitted electronically, but instead specifies that such submissions are permissible. House Bill 430 would waive the 10-percent penalty for real estate taxes within the first year of property ownership if the tax notice was not received by the property owners during the first year of ownership. The property owners will pay the full amount of the property taxes due and present a copy of their deed to prove their date of purchase. According to bill sponsor state Representative Joe Emrick (R-137), every year property tax bills are mailed to property owners or their mortgage company, but if a property is purchased around the time the bills are mailed, the property tax bill may inadvertently be mailed to the previous owner or mortgage company, and the new owner never receives it. That, in turn, often causes the new property owners to be hit with a 10-percent penalty for late payment of a bill they never received. Before the committee approved House Bill 430, senators adopted an amendment to the bill I offered on behalf of Representative Emrick to address concerns raised by the Pennsylvania State Tax Collectors’ Association. The amendment provides liability protection for a tax collector who accepts a waiver and tax notice payment in good faith, as well as clarifies how waiver requests are handled for mobile or manufactured homeowners. Lobbyist Disclosure Reform Package Reviewed by Senate State Government CommitteeA package of four bills aiming to increase transparency in Pennsylvania was reviewed during a public hearing of the Senate State Government Committee this week in Harrisburg. The Committee heard testimony from the prime sponsors of the bills, the Pennsylvania State Ethics Commission, and the Pennsylvania Association for Government Relations. Senate Bill 801, sponsored by Senator Bob Mensch (R-Montgomery), would require lobbyists to register any client seeking state financial assistance or grants, as well as prohibiting any kickbacks or contingency fees for successful applications for taxpayer-funded grants. It would also require the reporting of any equity a lobbyist holds in a company they lobby for. Senate Bill 802, sponsored by Senator Kristin Phillips-Hill (R-York), would prevent government entities from hiring outside lobbyists, as well as prohibiting former lobbyists who become employees of the General Assembly from being lobbied by their previous colleagues for one year. Senate Bill 803, sponsored by Senator Lisa Baker (R-Luzerne), would prevent lobbyists from also being registered as political consultants, as well as prohibiting political consultants from lobbying any client they gave advice to. Senate Bill 804, sponsored by Senator Tommy Tomlinson (R-Bucks), would require all registered lobbyists to complete mandatory ethics training on a yearly basis. The Senate State Government Committee is expected to vote on this package of bills before the end of the year. More information about the hearing can be found on the State Government Committee’s website. Calling for the Protection of Banking Privacy

State Treasurer Stacy Garrity joined a coalition of 23 state treasurers, auditors and financial officers calling on President Joe Biden and U.S. Treasury Secretary Janet Yellen to dismiss proposals that would require private banks and credit unions to report to the Internal Revenue Service (IRS) account flows valued at more than $600. This proposal, which is part of the Biden Administration’s $3.5 trillion “American Families Plan” revenue proposal, would permit for the unnecessary monitoring of private banking activity of more than 100 million Americans. It would be one of the largest infringements of data privacy in our nation’s history and cause exceptional administrative burdens for our community banks and credit unions. The Pennsylvania Bankers Association, the Pennsylvania Association of Community Bankers, and the CrossState Credit Union Association all oppose this proposal. Senate Passes Bill to Allow for First-time Homebuyers Savings Accounts

This week, the Senate passed a bill to allow individuals to open a first-time homebuyer savings account with a financial institution. Home ownership strengthens communities and provides stability for families. A first-time homebuyers savings account will be an important tool in helping people overcome the financial obstacles to home ownership. Senate Bill 157 would allow individuals to open an account of up to $150,000 with a financial institution of their choice for the sole purpose of purchasing a first home. Funds from a first-time homebuyer savings account may only be used to pay or reimburse the eligible costs for the purchase of a single-family home in Pennsylvania. Since 2009, the number of first-time homebuyers has significantly decreased. According to the National Association of Realtors, the share of first-time homebuyers in the national home sale market has fallen from 45% to just more than 32%. Individuals taking advantage of a first-time homebuyers savings account will be able to deduct up to $5,000 on their individual taxes, or up to $10,000 for a joint account. The tax deduction can be for no longer than 10 years and may not exceed $50,000 within a ten-year period. Unused funds would be counted against an individual’s taxable income. The bill passed to the House of Representatives for consideration. Addressing Teacher Shortage by Improving Certification Process

The Senate unanimously passed a bill in response to the teacher shortage that would simplify the process for out-of-state teachers to obtain certification in Pennsylvania. The Commonwealth’s current process for approving out-of-state educators presents unnecessary barriers for qualified candidates who are seeking to obtain a certificate to teach in Pennsylvania. Senate Bill 224 will help make it easier to get experienced educators into Pennsylvania classrooms. Senate Bill 224 would allow an out-of-state candidate who has completed any state-approved educator preparation program (including field placement/student teaching) from an accredited institution of higher education to be eligible for a comparable in-state instructional certification. The bill would also require the Pennsylvania Department of Education (PDE) to recognize and accept out-of-state candidates’ qualifying scores on equivalent content tests toward PDE’s testing and certification requirements. It would also grant Pennsylvania certification to any candidate who holds a valid certificate issued by the National Board for Professional Teaching Standards – the most respected national professional certification available in K-12 education. According to PDE, the number of newly issued in-state instructional teaching certificates has dropped by 66% since 2010. Senate Bill 224 now moves to the House of Representatives for consideration. AgKam LLC Farm Protected Through PA’s Farmland Preservation Program

Pennsylvania has protected the 160-acre AgKam LLC Farm through the state’s Farmland Preservation Program. The crop and livestock operation located in Charleston Township, Tioga County, received an investment of $182,980 from the state program and $12,964 from the county program. Given the farm’s location outside of Wellsboro near the gateway to the Pennsylvania Grand Canyon and Scenic Route 6, the scenic area was at risk of conversion to vacation homes and secondary residences. Mansfield Municipal Authority Receives a Water Level Monitoring Grant from SRBCThe Mansfield Municipal Authority has received a grant as part of the more than $110,000 in grants this week announced by the Susquehanna River Basin Commission. The $3,220.00 grant for the Tioga County public water supplier serving Mansfield Borough and parts of Richmond Township will help with the purchase and installation of equipment needed to track water levels in production wells. Measurement of water levels or upgrading equipment in wells is a small but important part of a facility’s water monitoring program – one that may lose priority when financial resources are constrained. Data compiled as a result of this effort can accrue information about the sustainability of water resources for years to come. PennDOT Accepting Applications for Green Light-Go Funding Program

PennDOT will be accepting applications for the Green Light-Go Funding Program (Year 7) from October 18, 2021 through January 14, 2022. It is estimated there will be approximately $40 million available in State Fiscal Year 2022-23 for the competitive application and reimbursement grant program for existing traffic signal improvements. Projects awarded in this round must be completed by spring 2025. Please visit the PennDOT Traffic Signal Portal’s Green Light-Go page for more information. Dr. Richard G. Stuempfle Retires After 65 Years

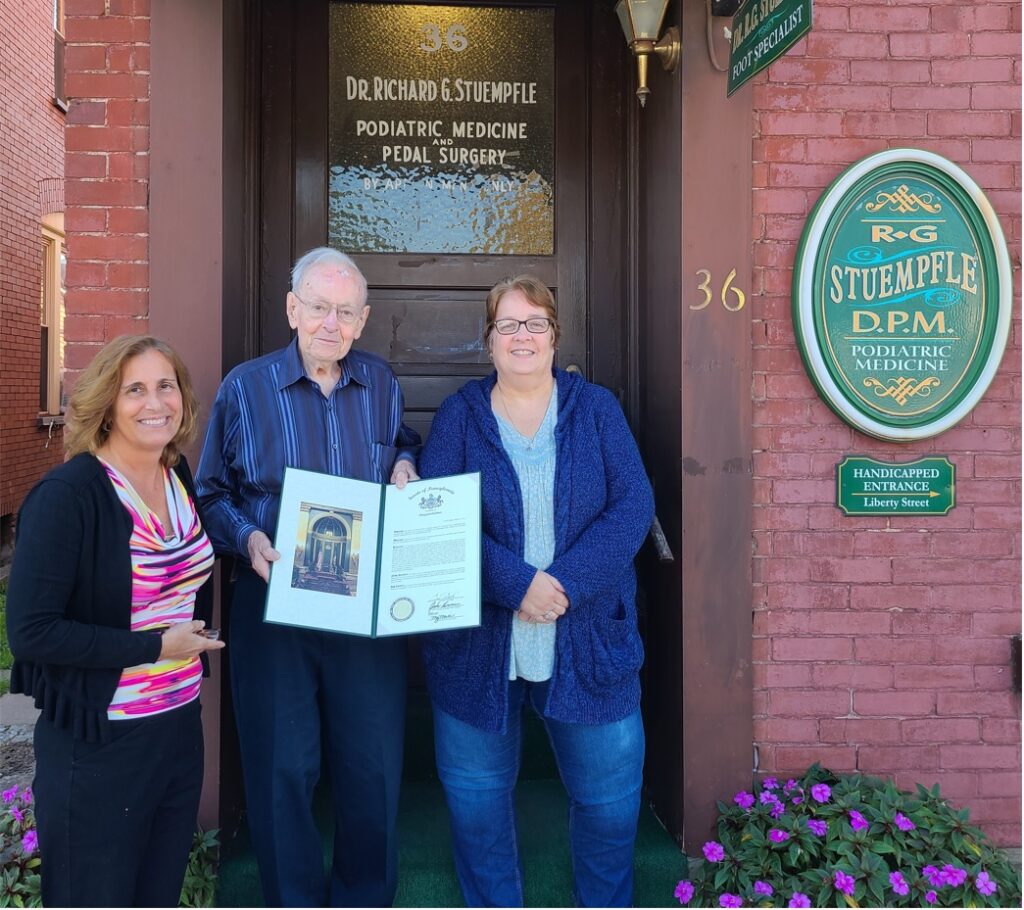

Pictured left to right, Deb Rudy, Senator Dush’s Wellsboro office, Dr. Stuempfle and Sandy Crays -RN Deb Rudy from my Wellsboro office presented Dr. Stuempfle a Senate Citation in honor of his retirement after 65 years. Dr. Stuempfle earned a bachelor’s degree from Lycoming college and medical degree from the Temple University School of Podiatric Medicine. He opened his podiatry practice in Lock Haven on November 21. 1955, on the ground floor of a two-story brick building, where he and his wife, the late DiAnn Hanna Stuempfle, raised their three children. A dedicated steward of his community, Dr. Stuempfle has been a member of the Lock Haven Rotary Club for more than fifty years and the Clinton County Shire Club. He served the podiatry profession as a member of the Family Practice Board at Lock Haven Hospital and the Pennsylvania State Board of Podiatry. Dr. Stuempfle is a past President, Vice President and Secretary/ Treasurer of the North Central Division of the Pennsylvania Podiatric Medical Association and Vice President of the Temple University School of Podiatric Medicine Alumni Association. To his great credit, he has been honored with the Temple University Gallery of Success Alumni Award and Pioneer of Podiatry Award. Throughout his career, Dr. Stuempfle has striven to adhere to the highest standards of service and has rightly earned the respect and admiration of his many friends and colleagues. Ways to Reduce Your Energy Usage and Costs

Since October is National Energy Awareness Month, it’s the perfect time to become more energy efficient. In addition to the environmental benefits, it will also benefit your wallet. Click here for ways you can reduce your energy usage and associated costs. Another way to potentially save on energy costs is by switching your electric supplier. In Pennsylvania, you can choose the company that generates your home or business’s electricity. This means you can choose a supplier that offers the lowest price or provides a specific service you want, such as renewable energy. While it is a good option for many, please ensure you obtain and keep written contract information from the company you are considering switching to. If the contract indicates a huge rate decrease but only makes it available for a short time and leaves open the rate going forward you may want to consider another vendor. Click here to shop for your electric supplier at PA Power Switch, the official electric shopping website of the Pennsylvania Public Utility Commission. Tips for Crime Prevention Month

October is Crime Prevention Month. In a past life I was the Crime Prevention NCO at Vandenberg Air Force Base in California. Avoiding being a victim involves informed citizens in addition to efforts of local law enforcement and a relationship with officers in your community. Informed citizens help to inform your law enforcement officers and help them serve you better. The National Crime Prevention Council is an excellent source of information and you can find easy crime prevention tips here. |

||||

|

||||

2024 © Senate of Pennsylvania | https://senatordush.com | Privacy Policy |